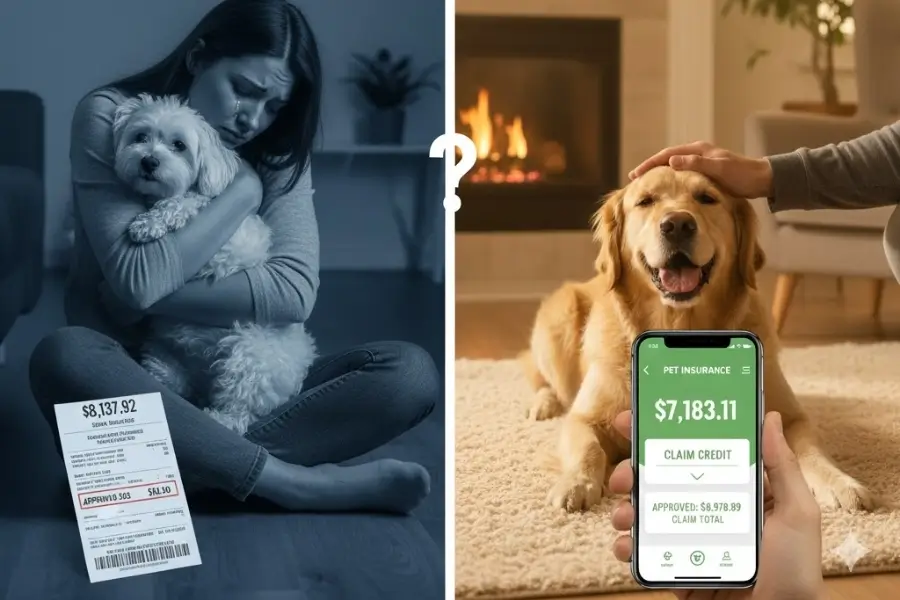

Bringing a beloved pet into your home comes with boundless joy, unconditional love, and, inevitably, expenses. Beyond the initial adoption fees, food, and toys, one of the most significant financial considerations for any responsible pet owner is veterinary care. With advancements in animal medicine, vets can now treat a vast array of conditions that were once untreatable, but these cutting-edge procedures often come with a hefty price tag. This is where pet insurance enters the conversation, promising peace of mind against unforeseen medical costs. But is it truly worth the monthly premium?

This article will delve into a comprehensive cost-benefit analysis of pet insurance, helping you decide if it’s the right financial choice for you and your furry family member.

Understanding the Landscape: The Rising Cost of Veterinary Care

The cost of veterinary care has been steadily increasing, mirroring trends in human healthcare. Pet ownership is a long-term commitment, and throughout their lives, most pets will face at least one major illness or injury that requires significant veterinary intervention.

Examples of common vet costs:

– Emergency visit: $200 – $1,000+

– Broken bone repair: $2,000 – $5,000+

– ACL tear surgery: $3,000 – $6,000+

– Cancer treatment (chemotherapy/radiation): $5,000 – $20,000+

– Foreign object removal surgery: $1,500 – $4,000+

– Chronic illness management (e.g., diabetes, kidney disease): Hundreds to thousands annually

Without insurance, these bills can put pet owners in a difficult position, forcing them to choose between their pet’s health and significant financial strain.

How Pet Insurance Works

Pet insurance functions much like human health insurance, but with a key difference: it’s typically a reimbursement model. You pay your vet bill upfront, then submit a claim to your insurance provider for reimbursement.

Key Terms to Understand:

– Premium: The monthly or annual fee you pay for coverage.

– Deductible: The amount you must pay out-of-pocket before your insurance starts to reimburse you. This can be annual or per incident.

– Reimbursement Level: The percentage of the vet bill that the insurance company will pay after your deductible is met (e.g., 70%, 80%, 90%).

– Annual Limit: The maximum amount the insurance company will reimburse you in a policy year.

– Waiting Period: A period of time after you purchase the policy before certain conditions are covered.

– Pre-existing Conditions: Illnesses or injuries that occurred or showed symptoms before your policy started or during the waiting period. These are typically not covered.

Types of Pet Insurance Plans

Most providers offer a few different types of plans:

– Accident-Only: Covers unexpected injuries (e.g., broken bones, snake bites, car accidents). Generally the most affordable.

– Accident & Illness: The most popular and comprehensive plan, covering accidents, common illnesses, serious conditions, and sometimes emergency care and surgery.

– Wellness Add-ons: An optional addition to an Accident & Illness plan, covering routine care like annual exams, vaccinations, and dental cleanings.

The Cost: What Can You Expect to Pay?

Premiums vary widely based on several factors:

– Pet’s Breed: Purebreds, especially those prone to certain genetic conditions, often have higher premiums.

– Pet’s Age: Younger pets are cheaper to insure; premiums increase as they age.

– Location: Veterinary costs vary by region, affecting premiums.

– Chosen Plan: Comprehensive plans cost more than accident-only.

– Deductible, Reimbursement Level, Annual Limit: Higher deductibles and lower reimbursement levels lead to lower premiums, but more out-of-pocket costs later.

Average monthly premiums can range from $30 – $70 for dogs and $15 – $40 for cats, but this is a broad estimate. Get multiple quotes from different providers to see actual costs for your specific pet.

The Benefits: Peace of Mind and Financial Protection

The primary benefit of pet insurance is peace of mind. Knowing that you won’t have to make agonizing financial decisions in a crisis allows you to focus on your pet’s recovery.

– Avoid Economic Euthanasia: Sadly, many pets are euthanized each year because their owners cannot afford necessary life-saving treatments. Insurance can prevent this heartbreaking choice.

– Access to Best Care: With insurance, you’re more likely to approve expensive diagnostics, specialist visits, and advanced treatments without hesitation.

– Budgeting Predictability: While you still pay a premium, it’s a predictable monthly cost that helps offset potentially enormous, unpredictable vet bills.

– Support for Chronic Conditions: If your pet develops a chronic illness early in life, insurance can cover a significant portion of ongoing treatment costs for years.

The Drawbacks: What to Consider

Despite the benefits, pet insurance isn’t a perfect solution for everyone.

– Cost vs. Usage: For some lucky pet owners, their dog or cat might remain perfectly healthy throughout their lives, making the cumulative premium payments seem like a waste.

– No Coverage for Pre-existing Conditions: This is a major limitation. If your pet already has a chronic condition, it won’t be covered. This highlights the importance of getting insurance when your pet is young and healthy.

– Waiting Periods: An accident or illness that occurs during the waiting period won’t be covered, which can be frustrating if you need care soon after purchasing a policy.

– Reimbursement Model: You still have to pay upfront, which means you need to have emergency funds available.

– Confusing Policies: Comparing plans can be complex, with varying deductibles, reimbursement percentages, annual limits, and exclusions.

0 Comments